Welcome to the Klever Daily Update (KDU), where we (ChatGPT and I) try to bring together as many pieces of the Klever puzzle together in a meaningful way.

1. Overview & Countdown

- Date: Tuesday, July 16, 2025

- Days until KVM goal (Aug. 20): 35

- KLV Price: $0.001985 (via CoinGecko)

- Daily Transactions: ~6,170

- Staked Supply Estimate: ~3.53 B KLV (~35%)

📊 2. Core Scorecard Snapshot

| Metric | Status | Score (/10) |

|---|---|---|

| Builder interest | 🟢 | 8 |

| Token circulation vs. staking | 🟡 | 6 |

| Narrative traction | 🟢 | 7 |

| Infrastructure performance | 🟢 | 8 |

| Regulatory posture | ⚪ | 5 |

Overall Score: 6.8/10

🧪 3. Fundamentals Watch

Tx‑to‑Reward Efficiency Ratio

- Formula: Validator Rewards ÷ Daily Transactions

- Validated Ratio for Klever: ~1,255 KLV ÷ 6,170 tx = 0.203

Peer comparison:

- Polygon, Avalanche, Harmony, Near, Fantom ratios sit between 0.009–0.016

Why it matters:

Maintaining a high reward-per-transaction supports both validator and KFI token demand.

KFI Tokenomics in Brief:

- Governance active

- Transaction-based rewards in place and scalable post-KVM

📈 4. Conviction Tracker & Confidence Model

| Signal | Score | Status | Reason |

|---|---|---|---|

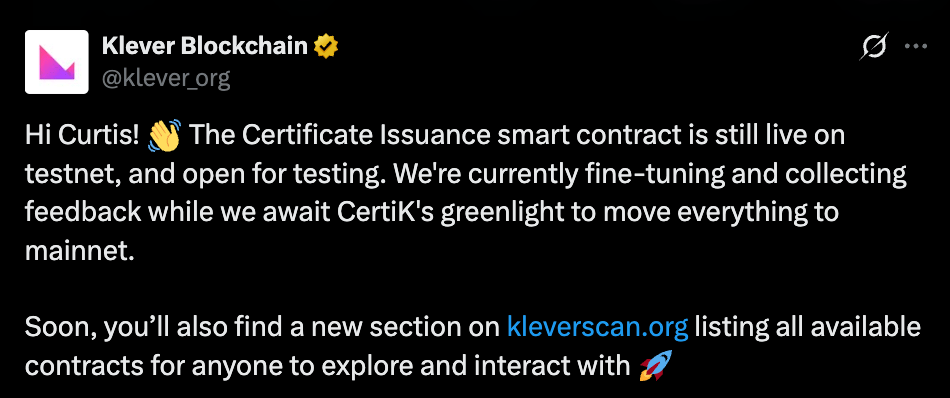

| Smart contract activity | 7 | 🟢 | Verified ZK testnet contract + new dev commits. |

| Token velocity vs staking | 6 | 🟡 | Healthy staking, moderate velocity persists. |

| Ecosystem/dApp expansion | 5 | ⚪ | Awaiting live dApp deployments. |

| KLV staking behavior | 7 | 🟢 | Over 35% locked—supports scarcity thesis. |

| Testnet smart contract deployments | 7 | 🟢 | New dev contributors pushing alongside core team. |

| Regulatory posture | 5 | ⚪ | Neutral, no new developments. |

| Exchange/listing potential | 5 | ⚪ | Dependent on KVM/go-live momentum. |

| Community growth & leadership messaging | 6 | 🟡 | Infra/ZK focus ramping, engagement steady. |

📉 5. Liquidity, Market & Price Forecast

- Resistance: $0.00202 → $0.00215

- Support: $0.00195 → $0.00187

- Time-to-target projections:

- $0.005 — Oct–Nov 2025 (FOMO by Sept)

- $0.01 — Q1 2026 (FOMO by late 2025)

🚨 6. Daily Alerts

- Whale-level sell walls emerging at ~$0.00210–$0.00215

- Infra/ZK mentions growing on Twitter/X

- New dev commits from previously untracked contributors alongside official testnet activity

💬 7. Sentiment Pulse

- Discord: Developer chatter increasing

- Telegram: Price speculation alive — users awaiting contracts

- Twitter/X: ZK/infrastructure narrative threads gaining traction

🧠 8. Narrative & Embedded Content

- Developer ecosystem is broadening: new contributor commits supplementing official efforts

- ZK certificate smart contract remains a key narrative signal awaiting live deployment

- No live dApp yet, but narrative shift showing Klever positioning toward infra/Web3 toolset

📣 9. Influencers I’d Like to See Talk KLV

- Tier 1: @APompliano, @Pentosh1, @ChrisBurniske

- Tier 2: @Route2FI, @DefiEdge, @Not3LauCapital

- Tier 3: Bankless (@banklesshq), Delphi Digital (@Delphi_Digital), Unchained Podcast

🔭 10. What I’m Watching For

- Confirmed KVM mainnet deployment (esp. Devikins or Pandemic Games)

- Meaningful dApp usage metrics, burn rates, tx counts

- Increased dev contribution rate and smart contract releases

- Influencer or media attention implying ZK/infra positioning

- Liquidity shift above sell-wall zones, including whale movement

Leave a comment